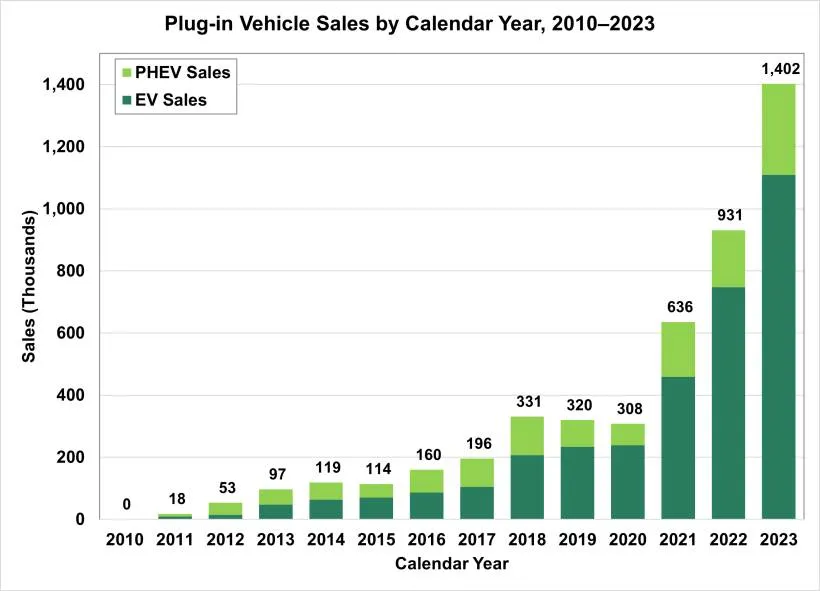

Plug-in hybrids reached record sales in 2023, with more than 250,000 vehicles sold, or about 20% of total plug-in vehicle sales, according to the Department of Energy.

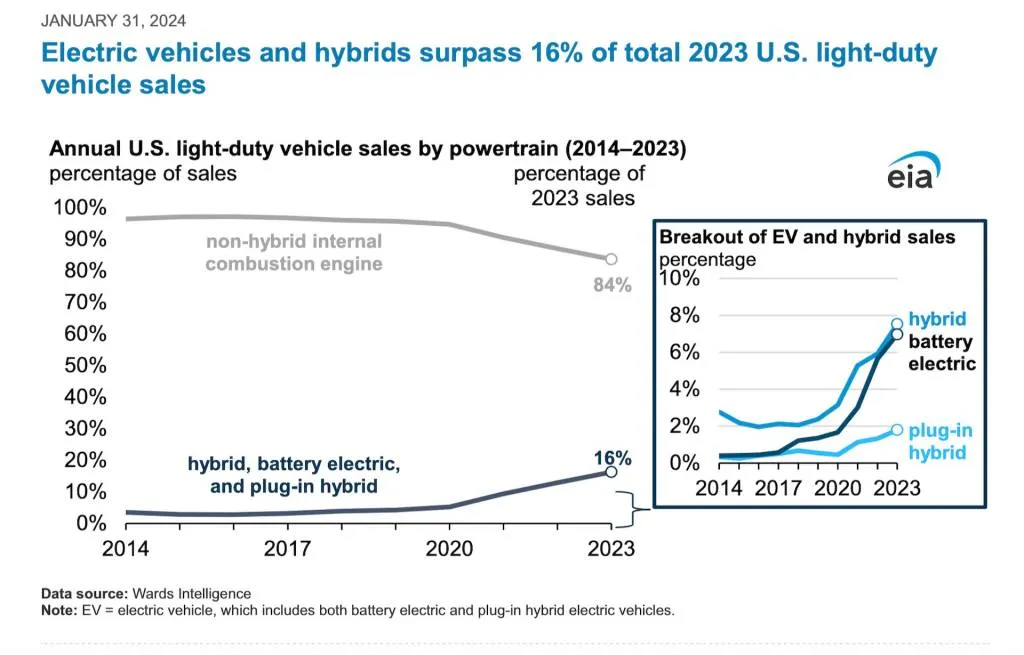

Last year saw strong sales for EVs as well, which surpassed one million units for the first time. The combined market share of hybrids, plug-in hybrids, and EVs rose to 16.3% of total light-duty vehicle sales in the U.S., up from 12.9% in 2022.

Plug-in vehicle sales by calendar year, 2010-2023 (via U.S. Department of Energy)

Yet by themselves, plug-in hybrids still haven’t reached 2% of new-car sales. With the price positioning of plug-in hybrids no longer as favorable versus hybrids in 2023—especially without the EV tax credit—it’s cause to wonder whether there is a lot more demand for them.

Some automakers seem to think so. The Energy Department statistics were released shortly after a report that General Motors will add plug-in hybrids to its U.S. lineup, reversing its previous policy of going all-in on EVs and ignoring hybrids of any kind.

U.S. EV and hybrid sales in 2023 (via U.S. Department of Energy)

Toyota plans to push its plug-in hybrid range to 120 miles, which would align with stricter California emissions standards calling for plug-in hybrids with at least 50 miles of electric range starting with the 2026 model year. Although the presentation needs to be straightforward. Toyota’s « hybrid EVs » marketing spin, recasting hybrids without charge ports as EVs, might only feed confusion.

Regulators must also still come to terms with plug-in hybrids that aren’t plugged in as often as is assumed when calculating emissions and efficiency ratings. Plug-in hybrids are only beneficial if they’re regularly charged and driven on electric power. And if owners aren’t doing that, it could become a bigger obstacle to reducing real-world emissions if plug-in hybrid sales continue to grow.