The reasons why EVs might not click for all car shoppers are evolving—and it’s no longer simply a matter of whether an EV will go far enough on a charge. Cost and the time needed to charge are now nearly as important to U.S. car shoppers as range, a Deloitte study published earlier this month found.

Time required to charge was listed as a concern by 50% of U.S. car shoppers surveyed, but 49% also listed driving range as a concern, and 48% listed price premiums as a barrier to an EV purchase.

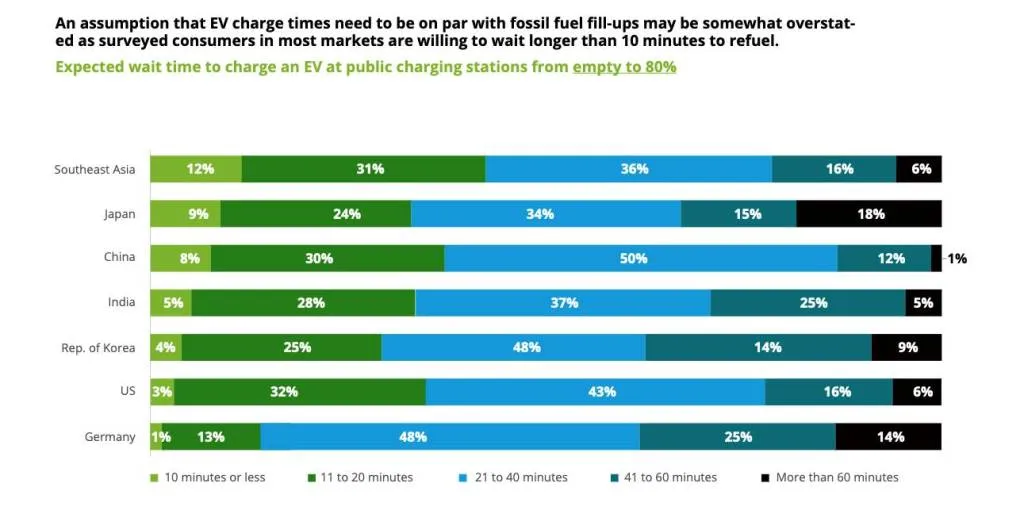

EV charging time expectations (from 2024 Deloitte study)

However, the study also indicated that consumers have realistic expectations of charging times and range. When asked how long they expected a charge from zero to 80% to take, most U.S. respondents—43%—said 21 to 40 minutes, while 32% said 11 to 20 minutes.

The largest number of U.S. consumers who would consider an EV (22%) said they expected 300 to 399 miles of driving range. That’s in line with what automakers are beginning to deliver, albeit with higher prices and longer charging times that may fall short of customers expectations. And the volatility of EV prices themselves over the past year may only serve to underscore that cost premiums remain pronounced.

2024 Ford F-150 Lightning Flash

It’s a hint that priorities are changing. A 2021 study, for example, listed range as the top priority for EV shoppers—well ahead of charging concerns. A J.D. Power survey last year, suggesting charging and purchase price as primary reasons for rejecting EVs, signaled that the tides were turning. J.D. Power also found that nearly half of shoppers see public charging as a dealbreaker.

While the lack of infrastructure, and the poor maintenance and support of the infrastructure itself, may be elements here, a 2022 study also suggested that non-EV drivers tend to underestimate the capabilities of an EV. So once shoppers make the jump, the chargers themselves might not prove to be as much of an issue.