According to a report citing GM directly, the Chevy Bolt EV will be the only EV from the automaker qualifying for the full EV tax credit from Jan. 1.

Yes, that’s a model now out of production and set to be increasingly difficult to find at dealerships in 2024.

GM did say that the Chevrolet Blazer EV and Cadillac Lyriq are due to regain tax-credit eligibility in early 2024. The company told Reuters that it expects its Chevy Equinox EV, Chevrolet Silverado EV, GMC Sierra EV, and Cadillac Optiq made “after the sourcing change” to be eligible for the full incentive.

Ford Mustang Mach-E, F-150 Lightning getting CATL LFP batteries

Additionally, Ford told Reuters that its E-Transit and Mustang Mach-E, currently both eligible for $3,750, will lose the credit completely. The Ford F-150 Lightning and Lincoln Corsair Grand Touring will keep their credit amounts of $7,500 and $3,750 respectively.

Why are some EVs falling to the wayside? Simply put, as sourcing requirements become more granular, qualifying gets far more complicated in a globalized auto industry.

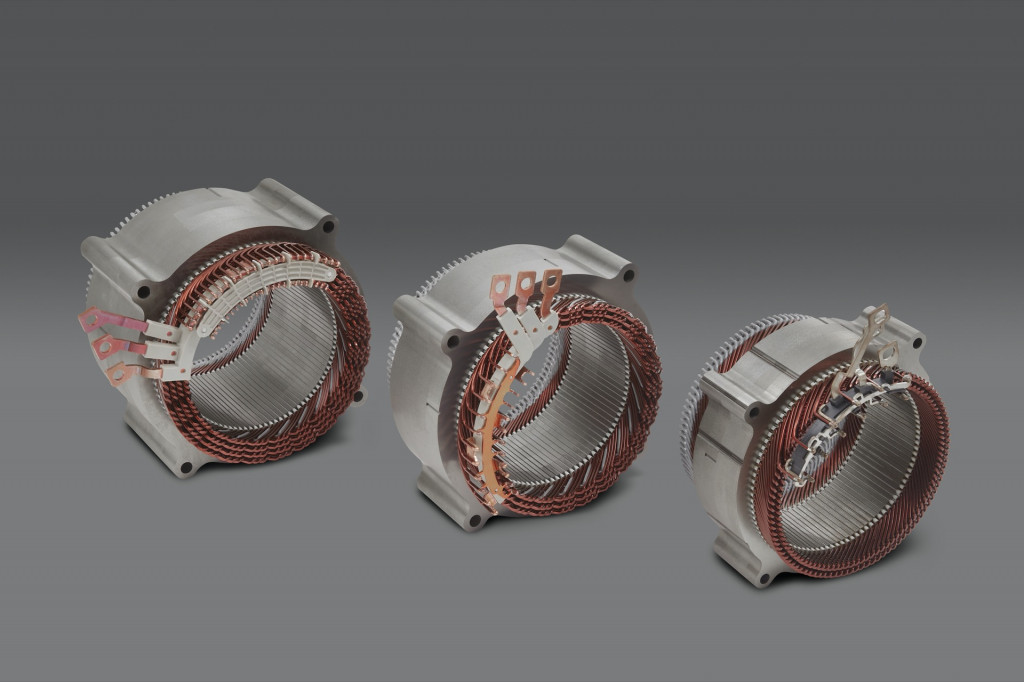

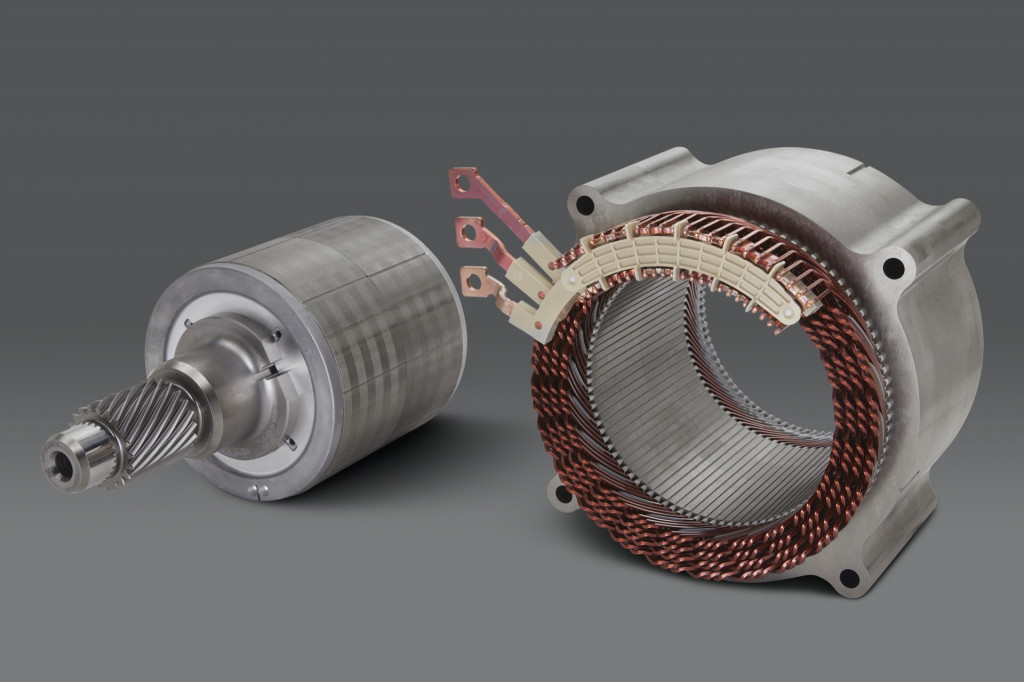

Motor family for GM Ultium-based EVs

For instance, with the Blazer EV, GM assembles the drive units in the same Ramos Arizpe, Mexico, complex that builds the Blazer EV itself. GM designed and engineered its Ultium motors in-house, but as an example the permanent-magnet motor used in various roles throughout the Blazer EV lineup is made by South Korea’s LG at plants in China and Mexico.

At GM’s recent media event for the Blazer EV, GM assistant chief engineer Patrick Lencioni, who oversees the motor suite that’s set to go into a number of its Ultium EVs, explained to Green Car Reports that it’s strategically working with LG in that case “to shift the footprint as needed,” depending on the sourcing rule.

Motor family for GM Ultium-based EVs

Starting January 1, the Treasury Department extends the foreign content limitation to other “low-value” components.

It’s the latest peg already written out as part of the Inflation Reduction Act championed by the Biden administration, the EV tax credit got a complete revamp last year into the Clean Vehicle Tax Credit, It retained its $7,500 maximum amount, and plug-in hybrids retained eligibility with a minimum battery capacity. But household-income and vehicle MSRP ceilings applied, vehicles needed to be assembled in the U.S., Mexico, or Canada, and as the years progressed, and the content of the components within EVs had to be sourced less from outside preferred U.S. trade partners.

Earlier this month the Department of Energy made that a step clearer—and stricter than expected—with “foreign entity of concern” language that excludes EV content from China, Russia, Iran, and North Korea in manufacturing and assembly or battery components, extending out to mining, processing, and recycling of critical minerals in 2025.

Green Car Reports has reached out to Ford and GM for details regarding which aspects keep these vehicles from meeting credit requirements—and to confirm the list.

2023 Tesla Model Y

GM and Ford aren’t the only ones expecting to lose tax-credit eligibility. Tesla earlier this month disclosed that the Model 3 Rear-Wheel Drive and Long Range models won’t qualify for the credit after Dec. 31, while just last week it suggested that some versions of the Tesla Model Y “likely” won’t retain the full tax credit amount.

There’s still room though for automakers to access a different credit intended for commercial vehicles that serves as a loophole for EV leasing—providing up to $7,500 off the overall cost of the lease, regardless of price caps or content requirements.

Also, starting in 2024, the tax credit will become an instant dealership rebate, with dealerships capable of tapping into it at the point of sale, helping some families to reduce the financed cost of new vehicles. It’s still up to households to assure their eligibility, though.