Highlights: The debate on the timeline of fully autonomous vehicles traveling on US highways rages on, with the optimists in the industry predicting initial applications to begin as early as 2019 and the skeptics questioning whether 2035 is a realistic launch date.

Experts agree that self-driving cars present the auto insurance industry with major challenges, but also with significant near-term opportunities.

The greatest potential of automated vehicles in the short term will derive from the vast amounts of data they create. Autonomous-vehicle manufacturers, software companies and insurers will all be interested in analyzing this data not only to improve existing products, but also to develop new value-added services. In addition, billions of dollars in premium revenue will be available to those carriers that are first to launch insurance services for this new risk category.

Introduction:

In this guide, we will cover:

What do we mean by ‘autonomous’

Who’s making self-driving cars and autonomous-driving technology?

Regulation of self-driving cars

Where are the testing locations for self-driving cars?

What do self-driving cars mean for the auto insurance industry?

Self-driving cars and big data

The human element and consumer attitudes toward driverless cars

The takeaway for insurers

The race for self-driving cars has been accelerating significantly in the last two years with more pilot programs popping up across the globe and more auto manufacturers and technology companies getting into the field.

While most experts agree wide consumer adoption is still years away, from a technology perspective the launch date for fully automated self-driving cars could be as early as 2019 in initial applications such as public transit or ride-hailing services.

How fast these autonomous vehicles will get to the point of widespread adoption will be impacted by a number of factors in addition to technology. These include regulation and legislation, the security of the data these cars need to operate, the ecosystem of supporting industries, including insurance, and of course consumer attitudes and ethics.

What do we mean by ‘autonomous’?

According to the Society of Automotive Engineers, there are five levels of automated vehicles:

Level 1: Driver Assistance. The driver controls the vehicle, but smart features enable the car to alert the driver to conditions, the environment and obstructions.

Level 2: Partial Automation. The vehicle has combined automated functions, i.e. acceleration and steering, but the driver remains engaged.

Level 3: Conditional Automation. The vehicle manages most safety-critical driving functions, but the driver must be ready to take control of the vehicle at all times.

Level 4: High Automation. The vehicle is capable of performing all safety-critical driving functions, but the driver has the option to control the vehicle.

Level 5: Fully Autonomous. The vehicle is completely driverless and will not feature driving equipment.

Level 4 is the “fully automated self-driving cars” to which experts refer currently.

Who’s making self-driving cars and autonomous-driving technology?

The clear leader in the industry is Google’s Waymo, which has conducted five million road miles of testing in 25 cities and many more in computer simulation. Its main fleet is comprised of Chrysler Pacificas, although key partners include Fiat, Jaguar and Honda ‒ and Lyft.

Among the auto manufacturers are well-known players such as Audi, Chrysler, Daimler, Ford, GM, Hyundai, Toyota, Volkswagen and Volvo, but there are also plenty of newcomers such as Faraday Feature, Local Motors, Lucid, and NextEV.

Altimeter Group, in its report titled “The Race to 2021: The State of Autonomous Vehicles and a “Who’s Who” of Industry Drivers,” gave detailed profiles of all auto manufacturers involved in autonomous-vehicle technology and development. It also featured some 50 hardware and software companies actively developing various components for autonomous vehicles. Tech giants Microsoft, Apple, Google and China’s Baidu have been leading the self-driving technologies, but there are many startups such as Comma.ai, Drive.ai and Oryx Vision getting involved.

Regulation of self-driving cars

In 2017, the U.S. Department of Transportation (DOT) issued a set of voluntary guidelines, called “A Vision for Safety 2.0,” providing recommendations and suggestions for industry’s consideration and discussion. They are designed to unify the development of automation features, including full autonomy and advanced driver assistance systems (ADAS), and to help unify industry, local, state and federal government efforts to that end. The guidance also streamlines the self-assessment process for companies and organizations. “This Guidance is entirely voluntary, with no compliance requirement or enforcement mechanism. The sole purpose of this Guidance is to support the industry as it develops best practices in the design, development, testing, and deployment of automated vehicle technologies,” the agency noted.

Earlier in 2016, the DOT had introduced 15 benchmarks automakers would need to meet before autonomous vehicles hit the road. It also asserted the rights of each US state to regulate insurance. The policy report, “Federal Automated Vehicles Policy: Accelerating the Next Revolution in Roadway Safety,” addressed the roles of the federal and state governments in regulating the emerging self-driving vehicle technology and issued this statement about liability: “States are responsible for determining liability rules for highly automated vehicles (HAVs). States should consider how to allocate liability among HAV owners, operators, passengers, manufacturers, and others when a crash occurs. For example, if an HAV is determined to be at fault ina crash then who should be held liable? For insurance, states need to determine who (owner, operator, passenger, manufacturer, etc.) must carry motor vehicle insurance. Determination of who or what is the “driver” of an HAV in a given circumstance does not necessarily determine liability for crashes involving that HAV. For example, states may determine that in some circumstances liability for a crash involving a human driver of an HAV should be assigned to the manufacturer of the HAV.”

This led to the introduction of a flurry of bills (more than 50 bills in 20 states) in 2017 providing some degree of regulation of self-driving cars. Twenty-two states and Washington, D.C., have either passed legislation or adopted regulations through a governor’s executive order.

In the summer of 2017, the first major U.S. bill on self-driving cars, the ‘‘SELF DRIVE Act,” got approval from the Energy and Commerce Committee in the House of Representatives. The bipartisan bill “would allow car manufacturers to put up to 25,000 autonomous vehicles on the roads in the first year of deployment. Over three years, that number would increase to a 100,000 annual cap. These vehicles would not be required to meet existing car safety standards.”

A U.S. Senate panel passed another bill, the “AV START Act,” two months later, barring states from imposing regulatory roadblocks and clearing the path for the use of autonomous vehicles. The Commerce, Science and Transportation Committee unanimously approved the measure, which would allow automakers to win exemptions for self-driving vehicles from safety rules that require cars to have human controls. States could set rules on registration, licensing, liability, insurance and safety inspections, but not performance standards.

Across the globe, U.K., Germany, South Korea and Singapore have enacted legislation allowing autonomous vehicles to be tested on public roads, with China close behind. “Those nations are outpacing the U.S., where the absence of national legislation to clarify a checkerboard of state rules hampers the deployment of driverless cars,” according to Bloomberg. In Europe, the U.K. is leading in shaping a conducive environment for testing, with four cities allowing public trials. France and Israel allow tests on their public roads on a case-by-case basis.

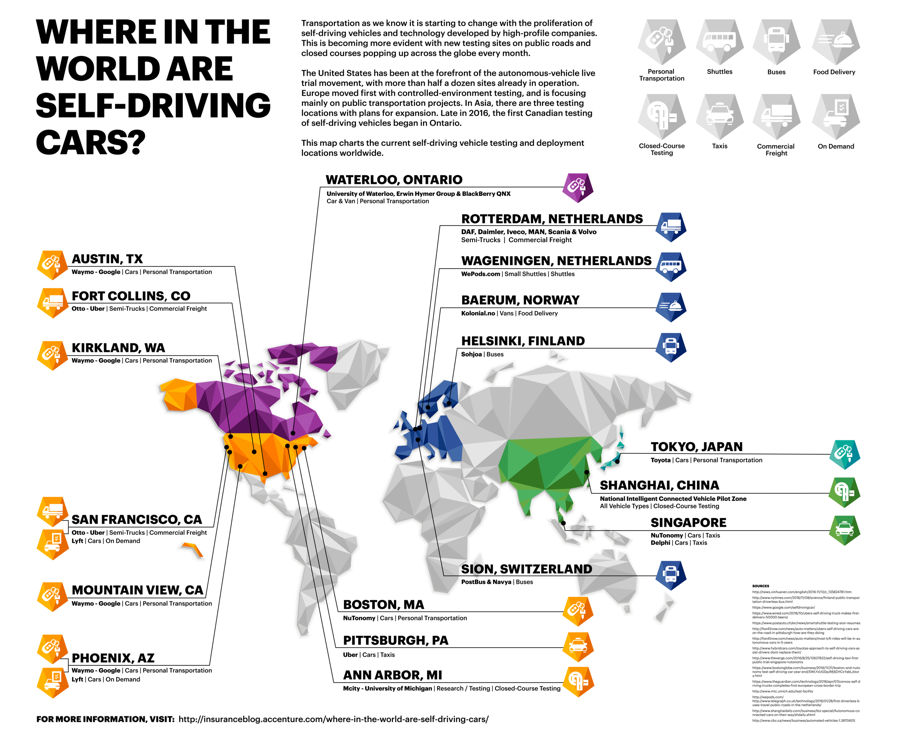

Where are the testing locations for self-driving cars?

California tops the list of driverless-car testing locations in North America, making it the largest open test ground in the world. The state adopted regulations for testing on public roads in September 2014, and an amendment in February allowed testers to try out the vehicles without a safety driver on board. Texas and Arizona have been close behind due their temperate climes, but after the fatal crash in Tempe earlier this year, Uber suspended all driverless-car testing in Arizona.

Earlier this year, Michigan became home to the world’s first highway testing facility for driverless cars. The American Center for Mobility (ACM) is a non-profit consortium backed by Michigan’s Department of Transportation, the University of Michigan, other state-sanctioned groups, as well as major businesses. The new highway division is a part of the 500-acre headquarters and testing grounds of the center, and includes a 2.5-mile loop, with on- and off-ramps, a 230-yard curved tunnel, customer garage and operations center. The outdoor facility will also enable automakers to test vehicles in winter driving conditions.

DOT has a pilot program at 10 locations across the U.S., from Iowa City to central Florida, to test autonomous vehicles in partnership with universities, cities and state departments of transportation.

While North America still spearheads the movement, there are plenty of testing locations in Europe and Asia. European self-driving vehicle tests tend to target public transportation in places such as Finland, Switzerland and the Netherlands. In Asia, Shanghai boasts a closed course, while Singapore is home to self-driving taxi service pilot route.

South Korea allows testing on 200 miles of public roads and is supporting construction of a test circuit south of Seoul, set to open this year, Bloomberg reported. Hyundai, Samsung Group, Volkswagen Group and Seoul National University and others are testing more than 40 driverless cars on public roads.

What do self-driving cars mean for the auto-insurance industry?

Whether self-driving cars present a threat or an opportunity to auto insurers has been the topic of many debates and research papers in the last couple of years.

“Autonomous technology will ultimately change the entire automotive industry and its supporting ecosystems and supply chains, ownership, financing and insurance,” wrote Brian Solis in the Altimeter report. “With the autonomous industry racing from zero to warp speed, every aspect of the driving world is set for innovation and transformation.”

Warren Buffett told CNBC that when autonomous vehicles become commonplace insurance costs would plummet. However, he noted that disrupting an entire industry would take time.

“If I had to take the over and under [bet] 10 years from now on whether 10 percent of the cars on the road would be self-driving, I would take the under, but I could very easily be wrong,” he said. “It’s something that billions and billions and billions are spent on, and brains are being involved in it, so it could easily come sooner than I think. And it will be negative for auto insurers.”

A report by Morgan Stanley predicted that disruptors could grab 20 percent of the auto insurance market. The analysis, based on a consumer survey conducted in collaboration with Boston Consulting Group, found that more than 26 percent of the respondents said they would purchase auto insurance from Apple, Google, or even AT&T and Verizon.

“Widespread adoption of autonomous vehicles will completely transform the motor insurance sector in the long term as liability shifts towards manufacturers and the traditional risk pool shrinks,” London-based Fitch Ratings noted in its driverless-car study.

Our Insuring Autonomous Vehicles report, based on research from Stevens Institute of Technology, concurs: “As many as 23 million fully autonomous vehicles will be traveling US highways by 2035. [This] presents the automobile insurance industry with major challenges, but also with a significant near-term opportunity.”

Leveraging this opportunity will require a major cultural shift in insurance organizations, our report contends. It also highlights the areas with the most favorable possibilities: 1) cybersecurity, 2) product liability insurance for hardware and software, and 3) insuring against infrastructure problems. Insurers taking action now will, our report finds, have an important first-mover advantage, not only over other insurers, but also against new disruptors.

Munich Re is one such big player that decided to make an early move and partnered with a self-driving taxi service in California. The startup Voyage has been running trials in Villages Golf and Country Club, a retirement community in San Jose. “The agreement to offer self-driving car rides in the retirement community almost fell apart when negotiations hit an impasse over insurance,” according to an article in The New York Times. “California requires autonomous vehicles to have $5 million of coverage, but the Villages insisted on 50 percent more coverage because it is a private community with more liability risk.” Munich Re stepped up to the plate, with one request from Voyage: to provide all sensor data, so the insurer could better understand the potential risks.

Technology Vision for Insurance 2018, our global survey of business and IT executives, gives a look at how insurers view autonomous vehicles currently and the potential around them.

Self-driving cars and big data

Self-driving cars generate a lot of data and need a lot of data with which to operate.

Brink magazine put it boldly: “Addressing concerns regarding data is key to the future of autonomous vehicles. In fact, the approach to data use and data governance issues for autonomous vehicles can help inform other technology innovators as they, too, look to generate, collect, store, analyze, and monetize vast amounts of data.”

Autonomous vehicle manufacturers, the software companies that create the machine learning systems, and insurers will all be interested in analyzing this data to not only improve existing products, but also to develop new value-added services. Brink estimates the potential value of data generated by autonomous vehicles to reach $1.5 trillion by 2030, adding: “Big data and autonomous vehicles make a perfect match. During operation, autonomous cars will generate data that automakers or suppliers may use to improve safety, reduce the amount of time spent driving, and lower the cost of operating a vehicle. At the same time, data could be used for research and development or to optimize and customize marketing based on a holistic customer-value management approach.”

Last year, Toyota announced its partnership with The Massachusetts Institute of Technology Media Lab and a variety of startups to look into how blockchain technology may be applied to driverless cars. Toyota’s partners include BigChainDB based in Germany; Commuterz in Israel; Oaken Innovations of Dallas and Toronto; and Los Angeles-based Gem. Other car and technology companies are looking to crowd-sourced maps for more accurate navigation tools for self-driving vehicles. BMW, Intel, Mobileye and Here have partnered in a project that will harness daily camera images from millions of vehicles and develop a map that can be updated daily.

The human element and consumer attitudes toward driverless cars

While the enthusiasm of auto manufacturers and tech companies is amping up, consumer confidence in self-driving cars seemed to lag behind at first. Drivers cited safety concerns and affordability as the main reasons for their hesitance.

Then the tide started to turn. A Cornell University research study found that the average driver would be willing to pay nearly $5,000 more for a fully automated vehicle.

Another survey by American International Group (AIG) found that Americans are pretty much evenly divided about driverless cars: Forty-one percent of survey respondents said they are uncomfortable with the idea of sharing the road with driverless vehicles, while 42 percent were generally OK with it.

A large majority (75 percent) of respondents worried that fully driverless vehicles, and even ones with autonomous features (emergency braking, lane departure avoidance, etc.), are susceptible to hackers.

“There are many ways for the driverless vehicle story to unfold over the next several years. It is critical for insurers to carefully watch the trend to help prepare clients–both consumers and businesses,” said Gaurav D. Garg, CEO personal insurance, AIG.

The human element in self-driving cars doesn’t just end with whether or not people will buy them. Some auto manufacturers also worry about how humans will treat driverless cars. Dietmar Exler, chief executive of Mercedes-Benz USA, is worried that humans will “bully” driverless cars. When asked what’s taking so long to develop self-driving cars, he said, “It’s not technology, that’s advancing fast. It’s not insurance and liability issues. I do believe in lawyers. I’m a lawyer myself. We will solve these issues out. The real issue is humans.”

Volvo shares the same concern about bullying and decided to keep its early fleet of test vehicles in London unmarked so that they don’t look any different from a normal Volvo car.

And last but not the least, there are concerns about the ethics and morality of intelligent machines. The Massachusetts Institute of Technology (MIT) is gathering a human perspective on moral decisions made by machine intelligence, such as self-driving cars, with a project titled “The Moral Machine.” The online survey generates moral dilemmas, where a driverless car must choose the lesser of two evils, such as killing two passengers or five pedestrians. As an outside observer, people judge which outcome they think is more acceptable. “Help us learn how to make machines moral,” the introductory video asks.

The takeaway for insurers

There is a lot going on in the race for self-driving cars. The ecosystem around it is vast and confusing. While it may not mean that auto insurance will be obsolete anytime soon, carriers would be wise to start thinking about the shift in culture it will require and prepare themselves for the incoming disruptors. Whether fully automated driverless cars launch as early as 2019 or take until 2035, the carriers making the first moves to harness big data and form the crucial partnerships will be the ones taking the lead in autonomous vehicles.

Further reading on self-driving cars:

How Will Driverless Cars Change the Auto Insurance Industry