Under new guidance, many EVs lose partial or full tax credit.

Big rule changes for the U.S.’ federal electric vehicle tax credit have come into play for 2024. Good news first: Vetted dealers can give customers their credit at the point of sale, meaning no waiting until they file their taxes in 2025. The bad news is that rule changes regarding component sourcing mean many fully electric and plug-in hybrid vehicles that were eligible for up to $7,500 in 2023 no longer qualify, at least for now.

More electric-vehicle news and reviews

2024 EV Tax Credits

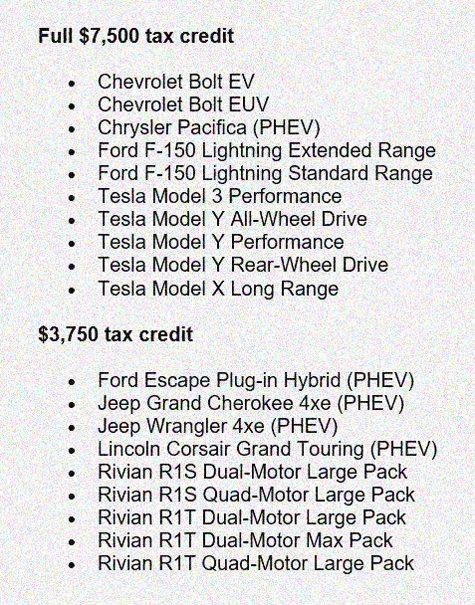

As of this writing, only 19 models can receive partial ($3,750) or full ($7,500) credit when there were 43 last year. While the Ford F-150 Lighting pickup is eligible for $7,500, the Mustang Mach-E falls off the list. The Chevrolet Bolt EV and Bolt EUV qualify for $7,500, but the Cadillac LYRIQ and Chevrolet Blazer EV get nothing. The Nissan Leaf has similarly been dropped, along with all variants of the Tesla Model 3 except the Performance grade.

These changes have left automakers scrambling to find new sources for the components that are causing their vehicles to not meet the new guidelines. Until it finds a fix, General Motors, the parent company of Chevrolet and Cadillac, is giving buyers a $7,500 factory incentive on the Blazer EV, LYRIQ, and any other models that become ineligible under the current rules. Note that in addition to component sourcing, vehicles must meet a pricing threshold so high-end EVs like the GMC Hummer EV and upcoming Cadillac Escalade IQ don’t qualify for the credit at all.

These changes have left automakers scrambling to find new sources for the components that are causing their vehicles to not meet the new guidelines. Until it finds a fix, General Motors, the parent company of Chevrolet and Cadillac, is giving buyers a $7,500 factory incentive on the Blazer EV, LYRIQ, and any other models that become ineligible under the current rules. Note that in addition to component sourcing, vehicles must meet a pricing threshold so high-end EVs like the GMC Hummer EV and upcoming Cadillac Escalade IQ don’t qualify for the credit at all.

Shoppers can go to the EPA’s website at www.fueleconomy.gov to see the full list of vehicles that are eligible for the federal tax credit, and it should be updated regularly as models are added or dropped. You can also do a VIN search for a specific model if one on a dealer’s lot strikes your fancy.

CG Says:

While it’s great that certified dealers can now provide the EV tax credit at the point of sale, the fact that more than half of previously eligible models no longer qualify is rather concerning. We get that you want as many parts as possible to be sourced from local or friendly global locations, but you also need to balance that with making EVs as accessible and affordable as possible if you want their adoption rates to continue improving.

Electric Vehicles that Qualify for the Federal Tax Credit (2023 list)

Listen to the Car Stuff Podcast