Strong growth in shipments of 4-5% is forecast for the global forklift market out to 2032, with greater competition driven by emerging technologies and rising global demand for logistics.

According to global market intelligence specialist Interact Analysis, this is expected to fuel further innovation and development opportunities for the industry over the coming years, as the market looks set to grow by 50%, from around 2m units in 2022 to c.3m units in 2032.

Poor demand in China led to a contraction of 12.4% in shipments during 2022, with the Americas and EMEA regions also witnessing a decline, leading Interact Analysis to reduce its forecast for 2023/24. Order volume is expected to fall by around 6% in 2023 to 2 million units, marking the first time since 2019 it has dipped below the shipment volume.

Covid-19 pandemic-related supply chain issues caused a significant difference between order and shipment volumes, leading to a historical peak of 370,000 units in 2021, as shipments lagged far behind orders. The sector has been catching up ever since, but with a sharp fall in order volumes, Interact Analysis predicts 2024 will be a low point for the market.

Major manufacturers driving recovery

However, there are clear signs of a recovery. This is particularly evident in the performance of major forklift manufacturers, with an increase in growth momentum of new truck business among these companies in 2023, following relatively slow growth over the past two years.

In its latest report, The Global Forklift Market – 2023, Interact Analysis reveals new business revenue for major forklift companies grew by 21% year-on-year during the first three-quarters of 2023 to reach $19.5 billion, significantly higher than the 5.2% recorded for the same period of 2022.

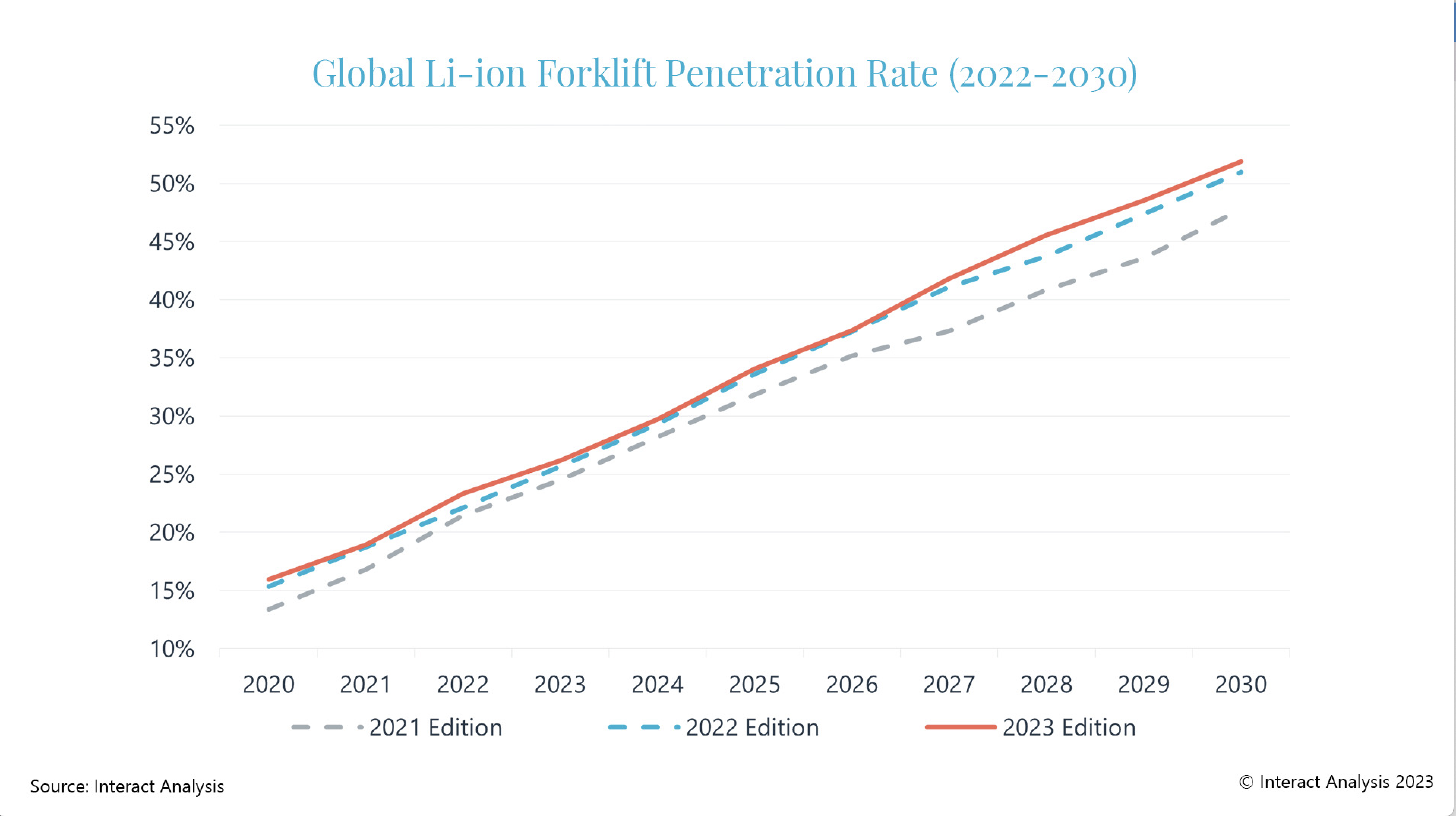

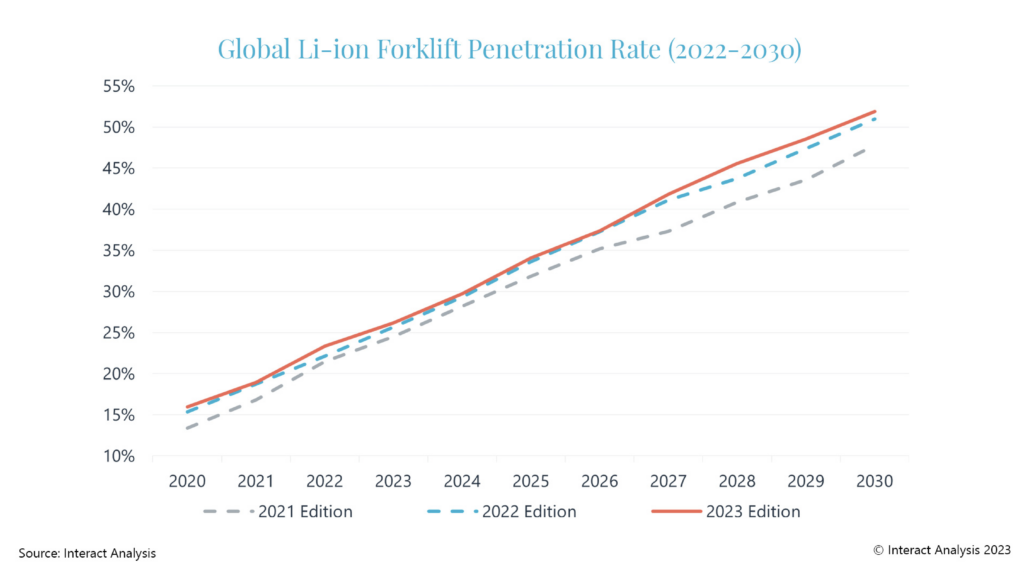

Key turning point for Li-ion penetration

Demand for electrified forklifts has been surging in recent years and Interact Analysis predicts China and several countries in Europe will achieve a 50% electrification rate for forklifts as early as 2025. The global market share of Li-ion models is anticipated to surpass 50% in 2030, with Class 3.1 predicted to be the first category to achieve over 50% electrification.

“Our study of electrification and autonomy trends in the forklift truck sector has revealed a challenging picture in the short-term,” says Maya Xiao, senior research analyst at Interact Analysis. “However, we are expecting the market to rally from 2025, headed by the major forklift manufacturers, and to see the growing trend for electrification accelerate as early adopters such as China and some of the European countries continue to lead the way.”